Double spending is a critical issue in digital currency systems where the same coin or token is spent more than once. While traditional financial systems rely on trusted intermediaries like banks to prevent fraud, Bitcoin solves this problem uniquely through its decentralized blockchain technology. Understanding how Bitcoin combats double spending not only highlights its innovation but also provides valuable insights into the workings of cryptocurrencies.

In this guide, we’ll explore the double spend problem, how Bitcoin prevents it, common attack methods, and practical tips to avoid risks. Let’s dive in!

Key Takeaways

- Double spending in Bitcoin happens when the same coin is used in two transactions, but Bitcoin’s blockchain prevents this by recording each transaction transparently.

- Bitcoin solves the double spend problem using its decentralized blockchain, ensuring transparency and security in digital transactions.

- Traditional financial systems rely on trusted third parties, but Bitcoin eliminates the need for intermediaries through a distributed ledger.

What Is the Double Spend Problem in Bitcoin?

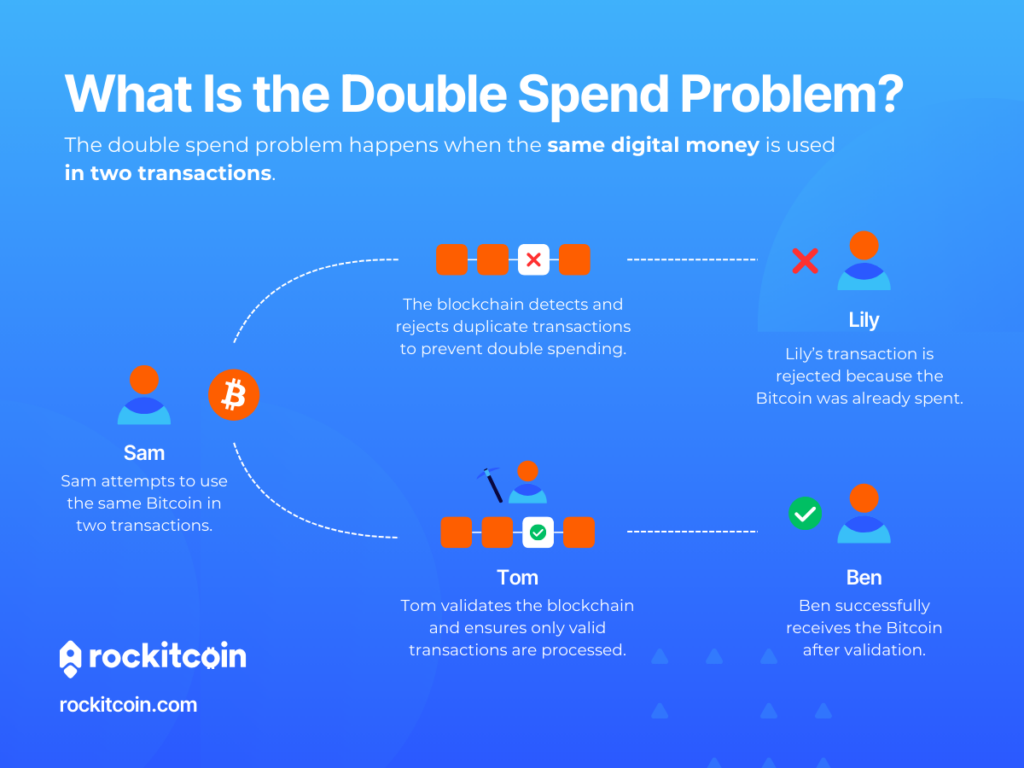

The double spend problem happens when the same digital money is used in two transactions. Imagine Sam attempts to send the same Bitcoin to both Ben and Lily. The blockchain detects duplicate transactions and rejects Lily’s payment attempt. This ensures only the valid transaction to Ben is confirmed. The validation process, carried out by a blockchain miner like Tom, guarantees that each Bitcoin can only be spent once, maintaining the integrity of the digital currency system. Without safeguards, both transactions could appear valid, causing confusion and potential fraud.

Unlike physical cash, which can’t exist in two places at once, digital money is just data and can be easily copied. This makes solving the double spend problem essential for any trustworthy digital currency system.

Why Is the Double Spend Problem Unique to Digital Money?

Physical money naturally prevents double spending because it’s tied to a tangible object. You can only hand a dollar bill to one person at a time. Digital money, however, exists as data, making it easy to replicate unless strict security measures are in place.

Before Bitcoin, digital currencies failed because they couldn’t solve this problem without relying on a central authority, like a bank, to verify transactions. Bitcoin’s innovation was its decentralized ledger, which lets everyone verify transactions and prevents double spending without needing a middleman.

The Evolution of Solutions to Double Spending

Centralized Financial Systems

Traditional financial systems use trusted third parties, like banks and payment processors, to prevent double spending. These institutions maintain private ledgers to track balances and verify transactions.

While effective, this system has drawbacks. Banks charge fees for their services, impose transaction limits, and can take days to settle payments. Additionally, they centralize power, meaning users must trust these institutions to act honestly.

Bitcoin’s Decentralized Approach

Bitcoin introduced a decentralized ledger called the blockchain. This global network of nodes keeps track of all transactions, so no single entity controls the system. With Bitcoin, users can verify transactions themselves, removing the need for trusted intermediaries and reducing fees and delays.

How Bitcoin Solves the Double Spend Problem

The Blockchain and Distributed Ledger

Bitcoin’s blockchain is a public ledger that records every transaction. Thousands of nodes worldwide store copies of this ledger and work together to validate new transactions. When you send Bitcoin, the transaction is broadcast to the network and added to the blockchain, ensuring it can’t be spent again.

This system ensures transparency and prevents fraud. Each node independently verifies transactions, creating a robust network resistant to tampering.

Time Stamping and Chronological Order

Each transaction on the Bitcoin network is time-stamped and added to a block in chronological order. If someone tries to spend the same Bitcoin twice, the network will only recognize the first transaction. This strict ordering ensures that double spending attempts are automatically rejected.

Transaction Confirmations

When a transaction is broadcast, it’s added to the mempool, a list of pending transactions. Miners then include it in a block, giving it its first confirmation. Each subsequent block adds another confirmation, making the transaction increasingly secure.

For most transactions, six confirmations are considered safe, as the likelihood of a double spend decreases significantly with each additional block.

Blockchain Reorganizations

Occasionally, two miners might create blocks simultaneously. The network resolves this by adopting the longest chain as the valid one. Transactions in the discarded block, called an orphan block, are returned to the mempool and re-confirmed. This ensures consistency across the network and further protects against double spending.

Common Double-Spending Attacks

1. Race Attack

A race attack involves sending two transactions at the same time: one to a recipient and one to the attacker’s own wallet. The attacker hopes their transaction gets confirmed first, invalidating the other.

2. Finney Attack

A Finney attack occurs when a miner pre-mines a block containing a fraudulent transaction. The miner then spends the same coins elsewhere, hoping the pre-mined block is added to the chain and invalidates the second transaction.

3. 51% Attack

In a 51% attack, a single entity gains control of more than half of the network’s mining power. This allows them to rewrite parts of the blockchain, enabling double spending and other malicious activities.

4. Sybil Attack

A Sybil attack involves creating multiple fake nodes to manipulate the network. While less severe than a 51% attack, it can disrupt smaller networks and make them vulnerable to fraud.

5. Blockchain Reorganizations

Reorganizations can cause temporary double spending when multiple valid blocks are mined simultaneously. The network resolves this by selecting the longest chain, ensuring that all transactions are ultimately validated.

Why Double Spending Matters

Double spending undermines trust in digital currencies, making them unreliable for both users and merchants. If people can’t trust that a transaction is final, they’re less likely to use the currency for everyday payments or investments.

Bitcoin’s blockchain addresses this issue by providing a transparent, tamper-proof system. Merchants can accept Bitcoin with confidence, knowing the network’s security measures make double spending practically impossible. This trust is vital for cryptocurrency adoption and long-term success.

How to Protect Yourself from Double-Spending Risks

- Wait for Confirmations: Always wait for at least six confirmations before considering a Bitcoin transaction final. This reduces the risk of reversals.

- Use Secure Wallets: Choose wallets that block unconfirmed transactions or provide warnings about potential risks.

- Stick to Reliable Networks: Conduct transactions on well-established blockchains like Bitcoin, which have proven security and large networks.

- Stay Informed: Learn about common attack methods and how to identify suspicious transactions.

- Leverage Blockchain Explorers: Use tools to track your transaction’s status and ensure it’s confirmed on the blockchain. Learn how to look up a Bitcoin address to track your Bitcoin purchases.

Conclusion

Bitcoin’s innovative blockchain technology effectively solves the double spend problem, ensuring trust and security in digital transactions. By eliminating the need for intermediaries and using a transparent, decentralized ledger, Bitcoin has set the standard for digital currencies.

Whether you’re a merchant, user, or investor, understanding double spending and how to prevent it is crucial for navigating the world of cryptocurrencies. Explore secure Bitcoin transactions with services like RockItCoin, which prioritize safety and ease of use.

Explore Bitcoin Today

Ready to experience secure and convenient Bitcoin transactions? RockItCoin offers a range of services tailored to your needs. Use our Bitcoin ATMs to buy and sell Bitcoin easily at thousands of locations nationwide. Prefer online options? Download the RockItCoin mobile app or buy right on our website. If you prefer to stay local, use RockItCoin Go for fast, reliable, and user-friendly cryptocurrency purchases at over 16,000 retail locations.

Use RockItCoin today to start your cryptocurrency journey with confidence!

FAQs About Double Spending in Bitcoin

What is double spending in simple terms?

Double spending happens when the same digital coin is used in two different transactions. For example, if someone sends Bitcoin to one person and tries to use the same Bitcoin to pay someone else, that’s double spending.

Why is double spending unique to digital currencies?

Physical money can only be in one place at a time, but digital money exists as data, which can be copied. Without safeguards, it’s possible to duplicate digital money and use it multiple times, making security essential.

How many confirmations are enough to secure a Bitcoin transaction?

Six confirmations are usually considered secure for most transactions. Each confirmation represents a block added to the blockchain, making it harder to reverse the transaction.

What is an orphan block?

An orphan block is a block that was part of the blockchain temporarily but got replaced because another chain became longer. Transactions in orphan blocks are returned to the mempool.

Can double spending occur on all blockchains?

Yes, but the likelihood depends on the blockchain’s size and security. Larger, well-established networks like Bitcoin are highly resistant to double spending, while smaller networks are more vulnerable.

How does Bitcoin’s blockchain prevent double spending?

Bitcoin’s blockchain uses a decentralized ledger where all transactions are publicly recorded. Nodes verify transactions, and time-stamping ensures that only the first transaction using specific coins is valid.