In recent years, the buzz around NFTs has been hard to miss. From multi-million-dollar digital art sales to their integration into gaming and virtual worlds, NFTs have become a big part of the digital economy. But what exactly is an NFT, and why is everyone talking about it? In this guide, we’ll explain what an NFT is, how they work, the pros and cons, and how to start using them.

Key Takeaways

- NFTs are one-of-a-kind digital tokens that show ownership of unique items or assets, like art, music, or virtual land.

- They use blockchain to ensure authenticity and make it easy to trace ownership using smart contracts.

- NFTs are changing industries like art, gaming, and collectibles by offering new ways to buy, sell, and interact with digital items.

What is an NFT?

NFT stands for non-fungible token. To understand what that means, let’s break it down:

- Non-fungible: Something that is unique and cannot be replaced with something else. For example, a one-of-a-kind painting is non-fungible, whereas a dollar bill or Bitcoin is fungible because one can be exchanged for another of equal value.

- Token: A digital asset that represents ownership or rights, often secured on a blockchain.

In simple terms, an NFT is a digital asset that is unique, verifiable, and stored on a blockchain. It could represent anything from digital art and music to real estate or even virtual sneakers.

Examples of NFTs:

- Artwork (e.g., Beeple’s “Everydays: The First 5000 Days”)

- Sports collectibles (e.g., NBA Top Shot highlights)

- Domain names

- Virtual real estate (e.g., Decentraland land parcels)

- In-game items (e.g., skins, weapons)

History of NFTs

NFTs have a fascinating history that predates their mainstream popularity. Here’s a timeline of key milestones:

- 2012-2013: The concept of blockchain-based assets first appeared with “Colored Coins” on the Bitcoin blockchain. These early experiments laid the groundwork for NFTs.

- 2014: The first official NFT, “Quantum” by Kevin McCoy, was minted on the Namecoin blockchain. It represented a piece of digital art.

- 2017: NFTs gained traction with projects like CryptoPunks and CryptoKitties, both of which were built on the Ethereum blockchain. CryptoKitties, in particular, brought widespread attention to NFTs by allowing users to breed and trade unique digital cats.

- 2021: The NFT market exploded, with Beeple’s digital artwork “Everydays: The First 5000 Days” selling for $69 million at Christie’s auction. This marked a turning point for NFTs in the art world.

- 2022 and Beyond: NFTs expanded beyond art into gaming, music, real estate, and the metaverse. They continue to evolve, with innovations like fractional ownership and eco-friendly blockchain platforms.

How Do NFTs Work?

NFTs are built on blockchain technology, the same system that powers cryptocurrencies like Bitcoin and Ethereum. However, unlike cryptocurrencies, which are fungible, NFTs are unique and irreplaceable.

Here’s how NFTs work:

1. Blockchain and Minting

NFTs are created through a process called minting, where the asset’s details are encrypted and recorded on the blockchain. This information includes a unique identifier, metadata (e.g., creator details, ownership rights), and sometimes smart contract rules.

2. Smart Contracts

Smart contracts are self-executing programs on the blockchain. They manage ownership, royalties, and transfer of NFTs. For instance, an artist can set up a smart contract to receive a percentage of sales whenever their NFT is resold.

3. Unique Identification

Each NFT has a unique code that distinguishes it from all others, even if multiple NFTs are part of the same collection. This makes ownership traceable and verifiable.

4. Transfer of Ownership

When an NFT is sold or transferred, the blockchain updates the ownership record, ensuring a secure and transparent transfer.

How Are NFTs Bought and Sold?

NFTs are traded on online platforms called NFT marketplaces. The process involves several steps:

1. Set Up a Crypto Wallet

A crypto wallet stores the private keys that give you access to your digital assets. Wallets can be “hot” (online) or “cold” (offline). Popular options include MetaMask and Ledger.

2. Buy Cryptocurrency

Most NFTs are bought using Ethereum (ETH), the cryptocurrency of the Ethereum blockchain. You can purchase ETH at RockItCoin ATMs or on the RockItCoin app.

3. Connect Your Wallet to an NFT Marketplace

Popular marketplaces include OpenSea, Rarible, and Nifty Gateway. Connect your wallet to these platforms to start trading.

4. Browse and Buy NFTs

Once your wallet is connected and funded, explore NFT listings. Some are auction-based, while others have fixed prices. When you make a purchase, the NFT is transferred to your wallet.

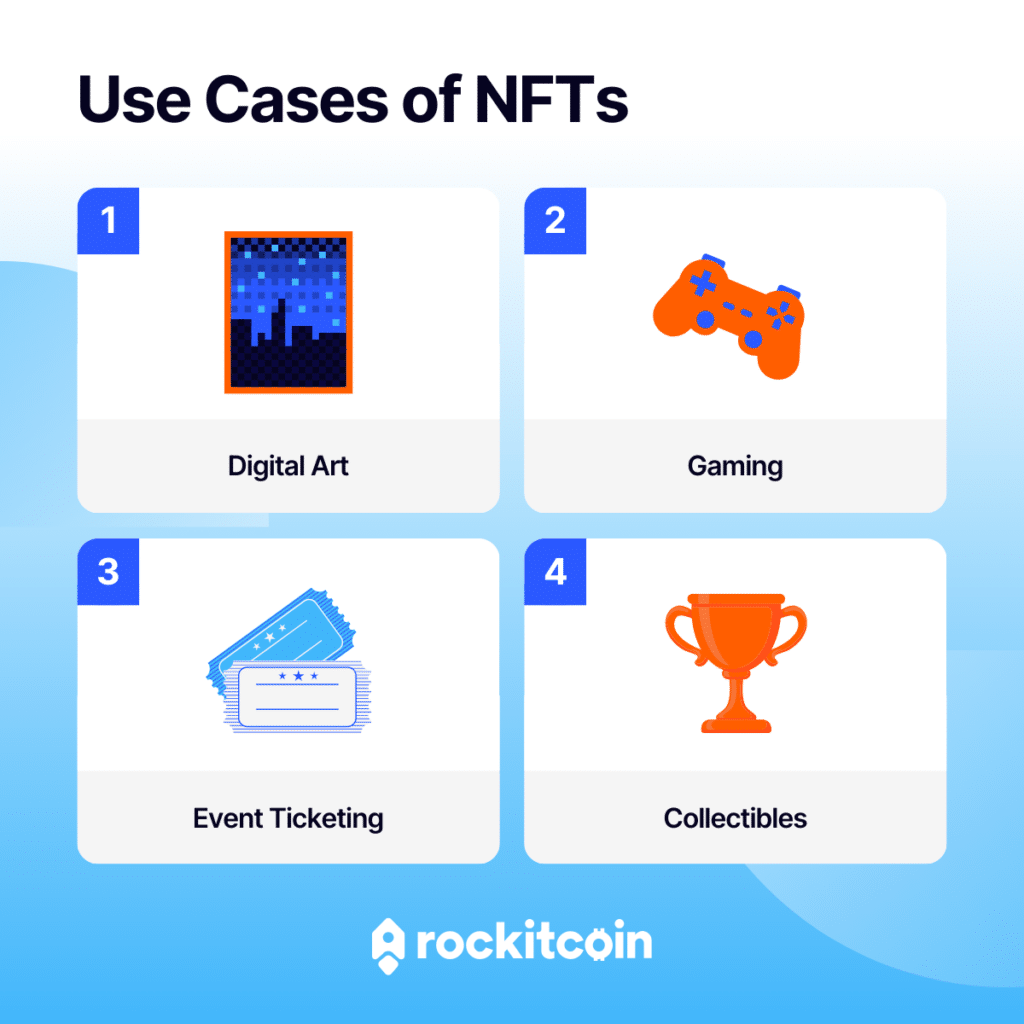

Popular Use Cases for NFTs

NFTs are transforming various industries by enabling digital ownership and new ways of interaction. Here are the most common applications:

- Digital Art: Artists can tokenize their work, ensuring authenticity and enabling royalty payments. For example, Beeple’s digital artwork sold for $69 million, setting a record for NFT art.

- Gaming: NFTs are used to represent in-game assets like weapons, skins, and characters. Players truly own these assets and can trade or sell them outside the game.

- Virtual Real Estate: Platforms like Decentraland and The Sandbox let users buy, sell, and develop virtual land using NFTs.

- Music and Media: Musicians can sell tokenized albums or grant exclusive access to concerts via NFTs. Kings of Leon released an album as an NFT, offering perks like concert tickets.

- Collectibles: NFTs digitize collectibles like trading cards or sports memorabilia, allowing fans to own and trade unique digital assets.

- Event Ticketing: NFTs provide tamper-proof digital tickets, ensuring authenticity and reducing fraud.

- Identity and Certification: NFTs can represent certifications, licenses, or digital identities, stored securely on the blockchain.

Benefits of NFTs

NFTs offer several advantages for creators, buyers, and industries:

Authenticity and Ownership

Blockchain technology ensures that NFTs are unique and ownership is traceable. This provides a reliable way to verify the authenticity of digital assets, reducing fraud and counterfeiting.

Royalties for Creators

Artists and creators can set up smart contracts to earn royalties on secondary sales. This ensures that creators continue to benefit financially as their work gains value over time, a feature not typically available in traditional art markets.

Market Efficiency

Tokenization removes intermediaries, allowing direct transactions between buyers and sellers. This streamlines processes like buying, selling, and transferring assets, making markets more accessible and efficient.

Accessibility

Fractional ownership lets people invest in high-value assets (e.g., art or real estate) by buying smaller shares. This democratizes access to investments that were once limited to wealthy individuals or institutions.

Global Reach

NFT marketplaces operate 24/7, connecting creators and buyers worldwide. This global availability enables artists and sellers to reach a larger audience, increasing opportunities for exposure and sales.

Risks and Challenges of NFTs

While NFTs have many benefits, there are also significant risks and challenges:

Scams and Fraud

Common scams include phishing attacks, counterfeit NFTs, and fake marketplaces. These scams often target new users who may not be familiar with how to verify the legitimacy of a platform or token. Always verify sources, double-check URLs, and use secure wallets to protect your assets.

Volatility

NFT prices are highly speculative and can fluctuate dramatically, leading to potential losses. This volatility is driven by market trends, hype, and buyer sentiment, making NFTs a high-risk investment.

Liquidity Issues

Finding a buyer for niche or less popular NFTs can be challenging. Unlike traditional assets, NFTs may not have a broad market, which could lead to difficulties in reselling or realizing their value.

NFT Marketplaces

There are various types of NFT marketplaces, each catering to different needs:

- Open Marketplaces: Platforms like OpenSea allow anyone to buy, sell, or mint NFTs. These marketplaces are versatile and cover a wide range of categories.

- Closed Marketplaces: Platforms like Foundation require artists to apply and be approved. These marketplaces often focus on high-quality, curated collections.

- Proprietary Marketplaces: Some platforms, like NBA Top Shot, focus on a specific type of NFT (e.g., sports highlights).

Common NFT Scams

NFTs have attracted scammers looking to exploit their popularity. Here’s how to protect yourself:

- Phishing Scams: Avoid clicking on suspicious links or pop-ups promoting NFT projects.

- Counterfeit NFTs: Verify the creator’s identity and check for official verification badges on marketplaces.

- Fake Marketplaces: Use reputable platforms and avoid deals that seem too good to be true.

- Pump-and-Dump Schemes: Be cautious of sudden hype around new NFT projects.

Safety Tips:

- Use strong passwords and enable two-factor authentication.

- Store high-value NFTs in cold wallets for added security.

- Research projects thoroughly before investing.

Conclusion

NFTs represent a revolutionary way to own and trade digital and real-world assets. While they offer incredible opportunities for creators and collectors, it’s important to approach them with caution. Whether you’re looking to explore NFTs for the first time or expand your crypto knowledge, RockItCoin is here to guide you through the world of blockchain and digital assets. If you’re ready to buy an NFT, you can purchase Ethereum through RockItCoin’s ATMs or mobile app to get started.

FAQs About NFTs

This blog was originally posted on May 26th, 2023, and was updated on January 28th, 2025, to provide the latest information on NFTs.