“Be fearful when others are greedy and greedy when others are fearful.” Those famous words from Warren Buffet, who is widely considered to be one of the most successful investors of all time, form the basis of the Crypto Fear and Greed Index.

The concept is a simple evolution of the basic principles of supply and demand. As demand for cryptocurrencies rises, so too does the price. And when a coin’s value shoots up, FOMO often persuades novice crypto investors to greedily buy-in at the inflated price. But as prices climb, early investors begin to sell, leaving the FOMO buyers lamenting the red numbers in their portfolios.

On the opposite side of the equation, falling prices often catalyze an irrational reaction to sell coins at a loss. The fear that the coin’s value will continue falling causes a drop in demand, which prevents the coin from rebounding immediately. And with the price refusing to climb, more investors get fearful, causing them to sell and lower the price further.

The Crypto Fear and Greed Index acts as a gauge of these market sentiments. It provides a snapshot of the current trends, letting investors know whether they’re buying into a market due for a correction. When the index reaches extreme fear, it can be a perfect buying opportunity. When the market reaches extreme greed, it might be a good time to HODL or even sell some coins.

Calculating the Fear and Greed Index

Every day, the software company alternative.me combines data about market sentiments from five sources into a single, easy-to-understand number from 0 to 100. Lower numbers signal a fearful market while higher numbers suggest a greedy market. But let’s discuss the data that leads to the numbers of the Crypto/Bitcoin Fear and Greed Index.

Volatility

One of the most important variables to the Crypto Fear and Greed Index is volatility. Alternative.me compares current market volatility with the averages over the last 30 and 90 days. Higher levels of volatility translate to a more fearful market.

Volume & Momentum

The Fear and Greed Index weighs volume just as heavily as volatility. It analyzes the volume and momentum of crypto purchases each day and compares them to the averages of the last 30 and 90 days. High buying volume tends to correlate with a greedy market.

Social Media

The number of crypto posts on social media and their levels of engagement form another piece of the puzzle. Currently, the Index only measures sentiment on Twitter, but it will soon include sentiments from Reddit as well. More posts and interactions are a sign of a greedy market.

Domination

Bitcoin has always been the dominant coin in the crypto market and is generally considered one of the safest investments in crypto. So as more people invest in other coins, that can signal that the market is shifting from safe bets to riskier ones. Thus, when Bitcoin’s dominance wanes, it can be a signal of a greedy market.

Trends

Similar to social media signals, data from Google Trends makes up the final piece of the Crypto Fear and Greed Index. The search volumes themselves aren’t all that helpful, but the change in volume can be incredibly telling. As search volumes for bearish terms like “bitcoin price manipulation” rise, the Bitcoin Fear and Greed Index skews toward fear.

How to Use the Crypto/Bitcoin Fear and Greed Index

The point of the Index is to help people make investment decisions without relying on emotion. When emotions take over, it can be hard to make rational decisions. The Crypto Fear and Greed Index helps you put your emotions in check and analyze how others are responding to the market instead of simply following the herd.

Rather than relying on the Index to make decisions for you, you may want to consult it after researching your decisions to buy or sell your coin(s) of choice. Doing so can serve as a check on your personal fear or greed and give you the time you need to reflect on your decisions before executing them.

In general, it’s rarely a good idea to use any single Index or data point for investment decisions. And the same holds true with this example. Only you can decide how to invest your funds. But the more tools you have at your disposal, the greater your chances of making a prudent investment.

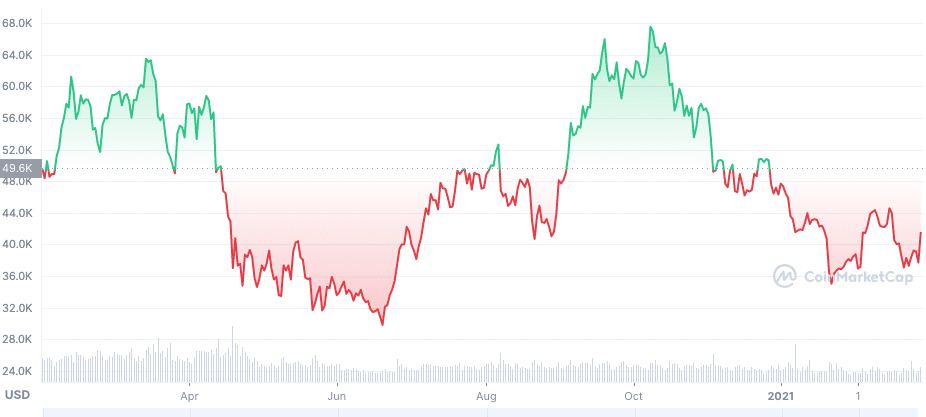

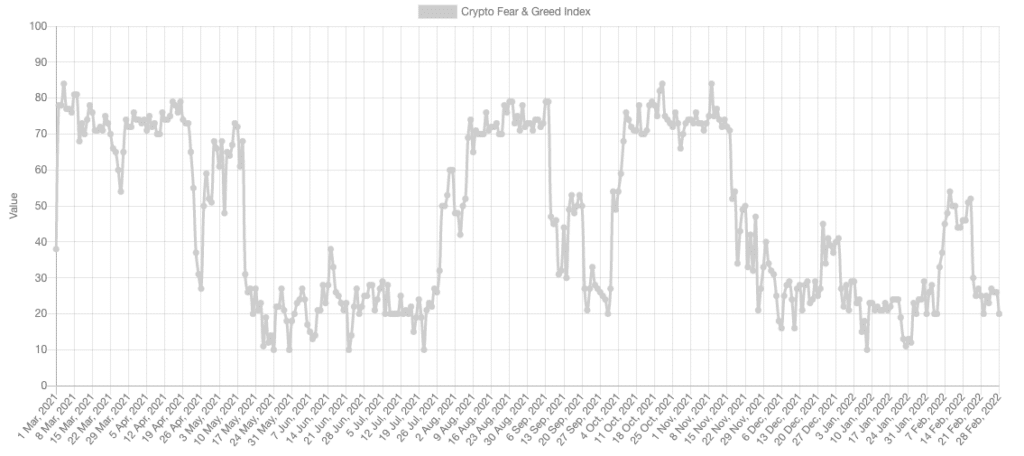

Bitcoin Price vs. Fear and Greed Index

Before wrapping up this article, we thought it might be helpful to show how the price of Bitcoin has correlated with the Bitcoin Fear and Greed Index over the last year. Feel free to analyze the following charts and draw your own conclusions.

If you feel so inclined, remember that you can always buy Bitcoin with a credit card here on our site. And with over 2,500 Bitcoin ATM locations throughout the US, there’s bound to be a location near you right now where you can buy or sell your coins for cash.