Welcome to This Week in Crypto, where we cover the top trending headlines in the cryptocurrency industry. The world of crypto news moves fast, and we’re here to bring it to you for your weekly digest. Enjoy this week’s top stories!

Over 101 Million NFT Sales Occurred in 2022, According to Report

Blockchain and decentralized application store DappRadar released a report detailing the last year in NFT and blockchain gaming statistics, revealing some interesting insights about the industry. 2022 saw a dramatic 67.57% increase in total NFT transactions with a total of over 101 million NFT sales! Ethereum remains the most popular blockchain for NFT transactions, securing over 21% of the market share and processing a total of 21.2 million transactions. The next popular blockchains are Wax, Polygon, and Solana, which remain favorites of many in the NFT community. 2021 and 2022 have been years of rapid growth and adoption for NFTs, and 2023 is likely to be more of the same!

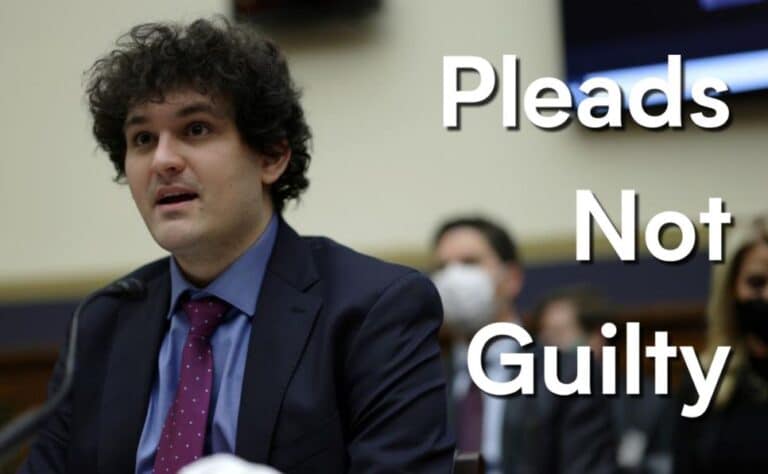

FTX CEO Considering Rebooting the Exchange, Despite Public Concerns

Current CEO of FTX John Ray indicated an interest in possibly rebooting the failed exchange in an effort to make its relationship with customers whole. The exchange recently reported that it had recovered up to $5.5 billion in assets that it could use to pay back investors and users. However, many former users may not trust any relations with FTX if it does come back, as consumer trust was broken in the most major way during its bankruptcy. FTX may not even be able to regain its licenses to operate in many areas, according to some in the crypto community. Would you trust a company like FTX to return your funds?

Iran and Russia Look to Create New Gold-Backed Stablecoin

The Russian government and Central Bank of Iran are cooperating to create and issue their own gold-backed stablecoin, enabling cross-border payments without the need for fiat currency. Anton Tkachev, member of the Committee on Information Policy, Information Technology and Communications, said that the project would only start once Russia properly regulates its digital asset market. It’s of note that both Russia and Iran have banned citizens from using cryptocurrencies as forms of payment. Their joint stablecoin could be viewed as an effort to please those who want to transact using digital assets and still allow governments to control the currency.