If you are new to crypto buying, trading, and investing, but unsure where to start as a beginner, you are not alone. Here is a breakdown of all of the things you need to know as a crypto beginner:

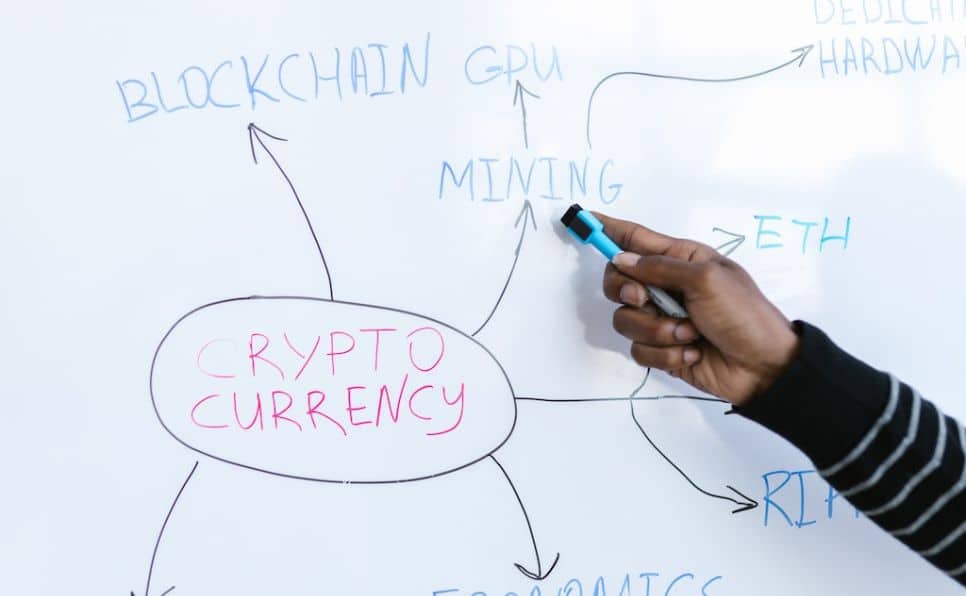

How Does Cryptocurrency Work?

Most currencies operate through centralized finance systems that require users to work with a middle man when moving money and assets. Cryptocurrency was invented to operate on a decentralized banking system that sends, receives, trades, and stores digital currency without a middle man. Instead, crypto is regarded as a “peer-to-peer” financial system.

Understanding blockchain technology is crucial to understanding the security and fidelity of cryptocurrency transactions. The blockchain is a public ledger that records digital transactions chronologically. Here is how it works:

A transaction is requested by an account through an exchange platform or a crypto broker

The transaction is sent out into a network of computers to encrypt the data and verify the transaction. This is when the mining process takes place, as miners solve cryptographic problems (called proof of work) to verify a transaction and record it on the block. Instead of requiring verification from a bank, transactions are verified by other users. The first miner to solve the cryptographic equation is rewarded with bitcoin. Once the transaction is verified it is written into a block. When the block is full, it is permanently added to a previous block on the blockchain.

The blockchain is legitimized by distributing each block into a network of nodes. Each node has a copy of the entire blockchain, which contains all the transactions ever made within the cryptocurrency network. Nodes work together to ensure that hackers and outages do not impact the fidelity of the data. When a new transaction occurs, it is broadcasted to all the nodes in the network. Each node independently verifies the validity of the transaction by checking factors such as the sender’s balance and ensuring the transaction adheres to the network’s rules. This distributed responsibility in the verification process helps prevent fraudulent or invalid transactions from being added to the blockchain.

Ultimately, nodes contribute to the security of the blockchain network through redundancy and decentralization. Since each node has a complete copy of the blockchain, it becomes challenging for malicious actors to tamper with or alter the transaction history. If one node is compromised or goes offline, the network can still function and maintain its integrity because other nodes have copies of the blockchain.

Eliminating the middle man through decentralized banking ensures that there is no single source of power over the record of transactions and ownership. This system works because cryptocurrency is encrypted to ensure security and fidelity on a blockchain system.

Why Use Crypto?

Crypto Transactions Are Quick

So why is using cryptocurrency better than using fiat currency? Well, cryptocurrency transactions are faster than fiat transactions because they are peer-to-peer transactions that do not require validation from the middle man. These quick transactions are especially beneficial for online businesses and international payments. Traditional centralized systems involve various intermediaries, including banks and payment processors. Each intermediary adds its own processing time, which can result in delays. In decentralized digital currencies, transactions occur directly between the sender and receiver, bypassing intermediaries and reducing the processing time.

Banks may also charge fees for international transfers of assets. Decentralized digital currencies operate on a global scale and are not restricted by geographical boundaries or time zones. Traditional banking systems often involve complicated cross-border transactions that require coordination between multiple banks and compliance with different regulations, which can lead to delays. Decentralized digital currencies facilitate fast and seamless transactions regardless of the sender’s and receiver’s locations. Without an intermediary, crypto transactions are much quicker.

Crypto’s Blockchain System Is Secure

Because crypto uses a blockchain system, the fidelity of its data is secure. Once a transaction is stored on a blockchain, it cannot be altered. Because the blockchain is a public ledger, it is widely distributed. This distribution makes it impossible to hack the cryptosystem, as each node cross-checks its digital data throughout the network it is a part of. If one copy of the ledger has been altered, the other nodes can easily single the corrupted data out.

Data Is Encrypted And Secure

Security is further amplified by the cryptographic processes in place to guard access to digital assets. Data in the blockchain is coded and decoded through cryptographic techniques so transactions are secure, transfers of assets are cryptographically verified, and the mining process (a process that produces more bitcoin) is regulated.

Crypto’s Decentralized Finance System Avoid Banking Fees

Another reason to use crypto is to avoid centralized banking fees. Because there is no centralized system to charge transfer fees, maintenance fees, deposit fees, etc. a decentralized finance system can be more cost-effective.

How To Make A Profit With Cryptocurrency?

Mining

Mining new bitcoin is one way to make money in the cryptocurrency system. How does this work? In the process of verifying transactions and solving complex mathematical problems, miners use powerful computers to reach a solution. The first miner to solve the problem is rewarded with new bitcoin. Miners also reap the rewards of transaction fees. Mining operates to fill blocks on the blockchain by verifying transactions. Mining prevents double-spending and creates incentives for users to help monitor transactional data. A new block is added to the blockchain every ten minutes. This means that every ten minutes, more cryptocurrency is minted and in circulation.

Not all mining “jobs” are equal in difficulty. The likelihood that your mining will solve the mathematical problem is dependent on the computational power of your tools and the difficulty of the mining puzzle. The difficulty of the mining puzzle is called Network Difficulty. The more miners there are working on a puzzle, the harder it is to find the answer.

Investing

Buying and trading crypto as an investment is another way crypto users can make money. Staking and yielding are two basic methods of crypto investing. Here are the basics:

- Staking cryptocurrency refers to the practice of buying crypto and letting it collect interest. Crypto staking is useful to verify transactions by providing proof-of-stake.

- Yield farming cryptocurrency refers to the practice of placing crypto into a decentralized application (like a crypto wallet). Yielding refers to the practice of using decentralized exchanges to earn interest by lending, borrowing, and staking crypto.

Accepting Bitcoin As A Business Owner

Accepting bitcoin as a form of payment is another way to make cryptocurrency. If you want to add more crypto to your digital assets, consider accepting crypto in exchange for your goods and services.

Play-To-Earn Crypto Games

Another way to make cryptocurrency is through crypto gaming. Cryptocurrency has grown alongside a boom in virtual universes and digital worlds. As virtual worlds have developed, crypto economies have grown. In play-to-earn crypto games, NFTs are bought and sold for millions of dollars. Digital earnings have real-world value, and cashing out on play-to-earn games has resulted in great rewards for players. Play-to-earn crypto games are also decentralized, making them secure through blockchain technology.

Buying and Selling NFTs

Non-fungible tokens are digital assets regarded for their scarcity. An NFT represents a piece of art or music that is stored on a blockchain to document transactions and ownership (just like any other form of cryptocurrency). Selling your art, designs, music, and even virtual real estate (in crypto play-to-earn games), can result in great profit for creators. The original artist of an NFT also earns royalties in subsequent sales of their work.

- Users can also make money by investing in NFTs, flipping NFTs, renting NFTs, trading NFTS, or staking and yielding NFTs.

Accessibility and Acceptance

Business owners and consumers mutually benefit from greater acceptance and accessibility when it comes to cryptocurrencies. The rise of cryptocurrencies has not only revolutionized oue financial landscape but also reshaped the way businesses conduct transactions. As digital currencies gain mainstream acceptance, an increasing number of forward-thinking businesses are embracing cryptocurrency as a form of payment. So, what types of businesses have adopted cryptocurrency payments? What is the significance of crypto’s accessibility for both business owners and consumers?

One of the prominent sectors that have embraced cryptocurrency payments is online retail. E-commerce giants like Overstock and Shopify have paved the way for accepting cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. By integrating crypto payment gateways, these retailers provide customers with a secure and convenient method to complete transactions. The global nature of cryptocurrencies allows businesses to expand their customer base beyond geographical boundaries, appealing to tech-savvy consumers who value privacy and decentralization.

The travel and hospitality industry has also recognized the benefits of cryptocurrency adoption. Some airlines enable customers to book flights and accommodation using Bitcoin. You now know that cryptocurrencies offer advantages such as lower transaction fees and faster cross-border payments, making them an attractive option for international travelers. Another layer of the appeal comes from crypto payments’ ability to provide an additional layer of security and protect sensitive customer information, reducing the risk of fraudulent activities.

Cryptocurrency adoption has even extended to the food and beverage industry. An increasing number of restaurants, cafes, and bars now accept cryptocurrencies as payment. This not only caters to the growing population of cryptocurrency enthusiasts but also attracts tech-savvy customers who seek innovative payment options. By accepting digital currencies, businesses can differentiate themselves from competitors, enhance customer loyalty, and tap into a niche market that values convenience and cutting-edge solutions.

It comes as no surprise that technology and software companies have been early adopters of cryptocurrency payments too. From software development platforms to web hosting services, many businesses in this sector accept cryptocurrencies as payment for their products and services. This aligns with the tech-savvy nature of their customer base and allows for seamless integration with digital products. Crypto payments also eliminate the hassle of traditional payment methods, such as international wire transfers, enabling tech businesses to expand their reach globally.

Cryptocurrencies have made significant strides into the realm of charitable donations too. Several well-known charities and non-profit organizations now accept cryptocurrencies, allowing individuals to contribute to social causes using their digital assets. Crypto donations offer transparency, traceability, and reduced transaction costs compared to traditional methods, ensuring that a larger portion of funds goes directly to the intended beneficiaries. This creates a sense of trust and accountability, attracting philanthropists who are passionate about leveraging the power of blockchain technology for social good.

The Significance of Crypto’s Accessibility

The accessibility of cryptocurrencies holds immense importance for both business owners and consumers. Here’s a breakdown of why:

Global Reach

Cryptocurrencies transcend geographical boundaries, enabling businesses to tap into a global customer base. For businesses, this means increased market opportunities, potential revenue growth, and reduced dependence on traditional banking systems. From a consumer perspective, crypto payments provide a convenient way to make cross-border transactions without the need for currency conversions or hefty fees.

Financial Inclusion:

Cryptocurrencies have the potential to foster financial inclusion, especially in regions with limited access to traditional banking services. By accepting cryptocurrencies, businesses empower individuals who may not have access to traditional banking facilities to participate in the global economy. This inclusivity is argued to enhance economic growth, drive innovation, and empower underprivileged communities.

Security and Privacy

Cryptocurrencies offer enhanced security and privacy compared to traditional payment methods. With cryptographic encryption and decentralized technology, crypto payments reduce the risk of identity theft, fraud, and chargebacks. For businesses, this translates into lower transaction costs, increased data protection, and improved customer trust. Consumers, on the other hand, enjoy the peace of mind that comes with secure transactions and control over their financial information.

Technological Advancement

By accepting cryptocurrencies, businesses position themselves as early adopters of emerging technologies. This demonstrates innovation, adaptability, and a forward-thinking approach, which can attract tech-savvy customers and set businesses apart from competitors. Embracing crypto payments also encourages the development of more user-friendly wallets and payment solutions, leading to further advancements in financial technology.

The acceptance of cryptocurrencies as a form of payment is gradually becoming more commonplace across various industries. From online retailers to travel agencies, businesses are recognizing the advantages of embracing crypto payments, including global reach, financial inclusion, enhanced security, and technological advancement. For consumers, cryptocurrency accessibility means increased convenience, privacy, and the ability to participate in the digital economy. As the cryptocurrency ecosystem continues to evolve, businesses that adapt to this new financial landscape are likely to thrive, catering to the growing demand for alternative payment options in an increasingly digital world.

As a beginner, you now know how cryptocurrency works, why cryptocurrency is worth using, various ways to make a profit with cryptocurrency, and why its accessibility and acceptance are important. Starting out as a crypto user can be intimidating if you do not know what to expect. You can use this page as a point of reference to nail down the basics and make a plan. Gaining crypto literacy is a great first step, and RockitCoin can help you take the next step in the right direction! To buy your first cryptocurrency, check out RockitCoin’s Crypto ATMs: to get started, all you need is cash and your phone number!