Imagine waking up to find your cryptocurrency exchange account frozen, hacked, or worse—bankrupt. Your funds? Gone. That’s the harsh reality many crypto investors have faced, and it all ties back to a fundamental principle: Not your keys, not your coins.

This phrase is more than just a saying in the crypto community—it’s a warning. If you don’t control your private keys, you don’t truly own your cryptocurrency. Self-custody is the foundation of financial independence in the digital asset world, ensuring that only you have access to your crypto holdings.

In this guide, we’ll break down the importance of private keys, the risks of custodial wallets, and how to secure your crypto properly, ensuring true ownership of your digital assets.

Understanding Private Keys & Public Keys

Before diving into the risks of custodial wallets, it’s essential to understand how private keys and public keys work in cryptocurrency.

- Public Key: This acts as your crypto wallet’s address. It’s what you share with others to receive cryptocurrency.

- Private Key: This is the secret code that allows you to access and control your cryptocurrency. If someone else gets hold of it, they have complete control over your funds.

Crypto wallets don’t store your coins. Instead, they store your private keys, which grant you control over your funds on the blockchain.

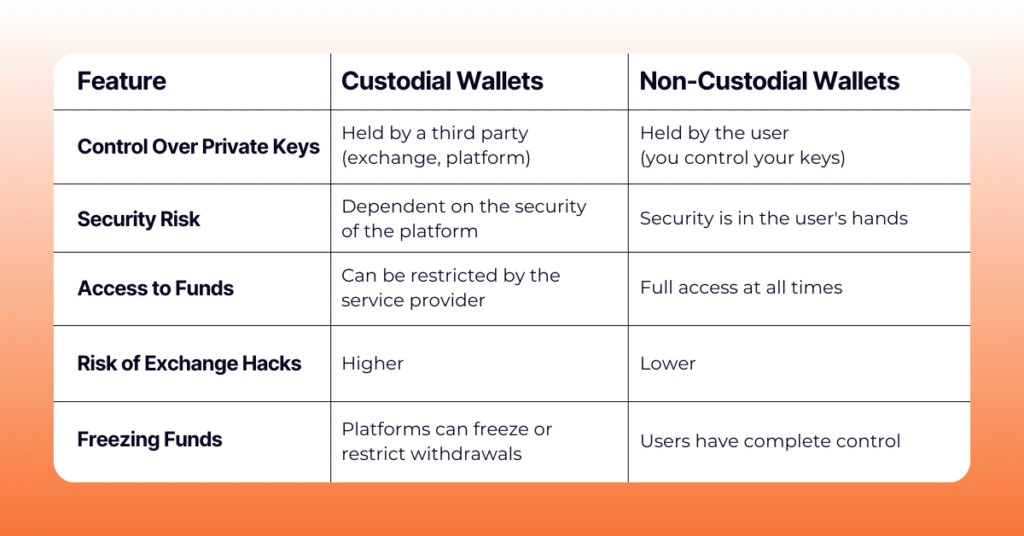

Custodial vs. Non-Custodial Wallets: What’s the Difference?

There are two main types of crypto wallets: Custodial and Non-custodial.

Custodial vs. Non-Custodial Wallets: A Comparison

Understanding the differences between custodial and non-custodial wallets is important for ensuring the security of your crypto assets. The table below highlights key distinctions:

Custodial Wallets (Not Your Keys, Not Your Coins)

A custodial wallet is one where a third party (such as an exchange) holds the private keys for you. Examples include wallets on centralized exchanges like Binance, Coinbase, and Kraken.

Risks of Custodial Wallets:

- Exchange Hacks: Billions of dollars have been stolen from exchanges over the years. One of the most infamous examples is the collapse of Mt. Gox in 2014, where hackers stole approximately 850,000 Bitcoin, worth billions today.

- Bankruptcies: If an exchange goes under (e.g., FTX, Mt. Gox), your funds can be lost forever. The collapse of FTX in 2022 was a prime example, where mismanagement, fraudulent activities, and a lack of transparency led to an $8 billion shortfall, leaving thousands of users unable to access their funds. The exchange’s downfall exposed the risks of trusting centralized platforms with custody of crypto assets.

- Frozen Funds: Exchanges can block withdrawals or freeze accounts due to regulations or financial troubles.

Non-Custodial Wallets (Your Keys, Your Coins)

A non-custodial wallet allows you to control your own private keys, ensuring full ownership of your cryptocurrency. RockItCoin’s mobile app is an excellent example of a secure, non-custodial wallet that puts you in control of your crypto.

Benefits of Non-Custodial Wallets:

- Full control over your assets, ensuring that you are the sole authority over your funds with no dependency on intermediaries.

- No risk of third-party failures, such as exchange collapses, withdrawal freezes, or mismanagement of funds that could lead to loss of assets.

- Greater security and privacy, as non-custodial wallets eliminate the need to share sensitive information with centralized platforms, reducing exposure to hacks and regulatory risks.

How Scams & Hacks Exploit Poor Key Management

Bad actors are constantly looking for ways to steal cryptocurrency. Some of the most common scams targeting private keys include:

- Phishing Attacks: Fake websites that trick you into entering your private keys or seed phrase.

- Fake Wallet Apps: Scammers create lookalike wallet apps to steal credentials.

- Clipboard Malware: Malicious software that replaces copied wallet addresses with the hacker’s address.

Learn more about bitcoin scams

Protecting Yourself

To stay safe from these attacks:

- Never share your private key or seed phrase.

- Use an offline hardware wallet or a secure non-custodial wallet like RockItCoin’s mobile app.

- Double-check URLs and wallet apps before entering sensitive information.

Best Practices for Securing Your Private Keys

To keep your crypto safe, follow these best practices:

- Use a Secure, Non-Custodial Wallet – The RockItCoin mobile app provides an easy and secure way to store your Bitcoin and crypto while maintaining full control over your private keys.

- Backup Your Seed Phrase Properly – Write it down and store it in a safe place, never on your phone or computer.

- Enable Two-Factor Authentication (2FA) – While it won’t protect your private keys, it adds an extra layer of security for your accounts.

- Use Cold Storage for Large Holdings – Hardware wallets provide extra security for long-term holdings.

- Buy Bitcoin with Self-Custody in Mind – When using RockItCoin Bitcoin ATMs, you must have your own wallet, reinforcing the principle of self-ownership.

Why Self-Custody Matters for Bitcoin & Crypto

Bitcoin was created as a decentralized financial system where users control their own funds, free from third-party interference. Self-custody aligns with this vision by ensuring that only you have access to your assets.

When you store your crypto in an exchange or custodial wallet, you’re trusting someone else with your money. History has shown this can be a costly mistake when exchanges shut down, freeze funds, or get hacked.

By using the RockItCoin mobile app and RockItCoin Bitcoin ATMs, you’re taking ownership of your crypto and ensuring that you, and only you, have control over your digital assets.

Own Your Keys, Own Your Crypto

The phrase “Not Your Keys, Not Your Coins” is more than just a saying—it’s a rule every crypto holder should live by. If you don’t control your private keys, you’re at risk of losing access to your funds due to hacks, scams, or exchange failures.

To ensure full ownership of your crypto:

- Use a non-custodial wallet like RockItCoin’s mobile app.

- Store your private keys securely and never share them.

- Buy Bitcoin the right way by using RockItCoin Bitcoin ATMs, which require you to have your own wallet.

Take control of your crypto today. Download the RockItCoin app and visit a RockItCoin Bitcoin ATM to start securing your digital assets the right way!

Common Questions About Crypto Self-Custody

This article was originally published on May 29th, 2023, and was updated on February 7th, 2025 to reflect the most recent information.