For the last five months, the inflation rate in the U.S. has exceeded 5%. The last time inflation climbed this high was in 2008, but it fell below 5% after just three months in the heart of that recession. It’s been 30 years since the U.S. has endured such a prolonged period of high inflation.

As the dollar loses purchasing power, many people are turning to cryptocurrencies to hedge against inflation, especially Bitcoin. Historically, precious metals like gold and silver helped people weather the storms of inflation because their value kept pace with inflation, or better. Many attribute this to their limited supply, a characteristic they share with Bitcoin.

What Is Inflation and What Causes It?

When a currency’s buying power decreases, we refer to that as inflation. In simpler terms, inflation is a measure of how much the prices of goods and services increase. If inflation reaches 5%, products that cost $20 a year ago would cost $21 today. The Consumer Price Index (CPI) helps measure inflation by providing average prices for a variety of goods every month.

Although the CPI makes measuring inflation fairly simple, determining the cause of inflation is less straightforward. The general principles of supply and demand suggest that increasing the supply of anything will reduce its value. Thus, increasing the supply of a currency should reduce its value. And while this often holds true, inflation is more complicated than that.

Since most measures of inflation rely on the CPI, the companies and individuals who set the prices for the products it tracks play a large role in defining inflation. But ultimately, consumers determine the value of products by purchasing them or passing them by.

We all collectively determine the value of goods and services, including the value of the US Dollar or Bitcoin. Thus, we collectively determine the inflation rate. So, in some sense, inflation is a result of a kind of mob mentality. When we agree that inflation is on the rise, we agree to pay higher prices, and inflation continues to rise.

While this view of inflation may make sense in theory, manufacturers typically raise prices to reflect increased costs. Over the pandemic, the supply of countless commodities decreased, forcing companies to charge more to keep their doors open. If we refuse to pay higher prices, some goods may no longer be profitable to produce, which could make them disappear altogether. And when those goods are essential, like food, we have no choice but to pay.

Bitcoin as a Hedge Against Inflation

Since the beginning of 2020, the supply of Bitcoin increased by less than 1 million. Over the next 20 years, roughly 2 million more will enter circulation. This will bring the number of Bitcoin in existence to 21 million. And according to its code, there will never be another Bitcoin created once this limit is reached.

When the U.S. detached its dollar from the gold standard during World War I, it removed the limit on the amount of money it can print. So the Treasury Department can decide to print more at any time. During the pandemic, the Federal Reserve added more than $3 trillion to the US money supply. Plus, they already have the authority to add another $3 trillion to the supply.

As discussed above, printing money doesn’t necessarily mean inflation rates will rise. But given the recent historic influx of money into the economy and interest rates that we haven’t seen since 1990, it’s safe to assume that the two are at least correlated in this case. And while the value of a dollar has decreased by roughly 5% since last year, the value of Bitcoin has increased by more than 600%.

Although the finite supply of Bitcoin almost certainly contributed to its rise in price, there are undoubtedly other factors at play. In fact, many other digital currencies have seen similar price movements, even some with no limit to their supply. Dogecoin, a coin with little to no practical value, rose nearly 10,000% over the last year despite its limitless supply.

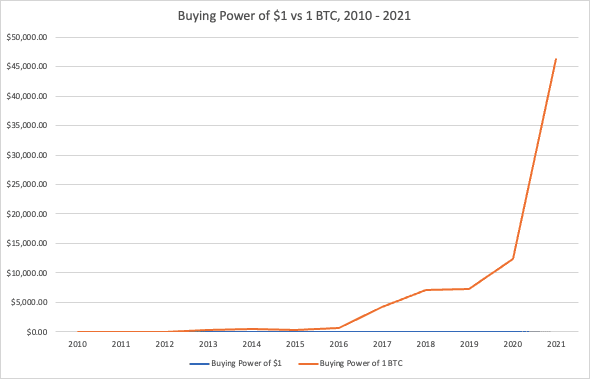

However you choose to explain the value of digital assets, Bitcoin has consistently outpaced inflation since its creation. And that’s putting it lightly. Take a look at the table and chart below to see how the purchasing power of $1 and 1 BTC has changed since 2010.

-

Year

Buying Power of $1

Buying Power of 1 BTC

2010

$1.00

$0.18

2011

$0.95

$5.68

2012

$0.93

$8.45

2013

$0.92

$260.35

2014

$0.91

$513.04

2015

$0.91

$276.23

2016

$0.89

$589.80

2017

$0.88

$4,299.76

2018

$0.85

$7,183.13

2019

$0.84

$7,325.84

2020

$0.83

$12,310.25

2021

$0.78

$46,331.86

These charts should make it pretty obvious that Bitcoin has done much more than simply outpace inflation. It’s been called the best investment of the decade for a reason. There’s no guarantee that Bitcoin will continue along this trajectory. But looking at its past performance, Bitcoin is an exceptional hedge against inflation.

If you want to invest, you can buy Bitcoin with a credit card right here on our site or from the RockItCoin app. You can also buy Bitcoin with cash at any of our Bitcoin ATM Locations.