In the world of cryptocurrency, Bitcoin and Litecoin stand out as two of the most recognized digital currencies. Bitcoin, often referred to as “digital gold,” was the first cryptocurrency to hit the market and has since become a store of value for investors. Litecoin, created a few years later as a faster, more accessible alternative, is commonly known as “digital silver.” Both share similar foundations, yet they serve different purposes within the crypto space. In this article, we’ll compare Litecoin and Bitcoin, highlighting their key differences and unique benefits.

Quick Takeaways

- Bitcoin is known as “digital gold” for its use as a store of value, while Litecoin is called “digital silver” for faster, everyday transactions.

- Bitcoin has a maximum supply of 21 million coins, whereas Litecoin has a larger cap of 84 million coins.

- Bitcoin and Litecoin can both be bought using RockItCoin ATMs and the RockItCoin mobile app.

Origins and Purpose of Bitcoin and Litecoin

Bitcoin’s Origins

Bitcoin was introduced in 2009 by Satoshi Nakamoto, who published the first-ever blockchain whitepaper. Bitcoin’s purpose was simple yet revolutionary: to create a decentralized, peer-to-peer currency that operates without a central authority, unlike traditional currencies controlled by governments and banks. Today, Bitcoin is widely accepted as a store of value, attracting institutional and individual investors alike.

Litecoin’s Origins

In 2011, Charlie Lee, a former Google engineer, launched Litecoin as a response to Bitcoin’s growing pains, particularly with scalability and transaction speed. Lee’s goal was to create a faster, more accessible cryptocurrency for everyday transactions. Known as a “lighter” version of Bitcoin, Litecoin was designed to handle transactions more efficiently, positioning itself as a practical choice for frequent use. Since its inception, Litecoin has earned its reputation as the “silver” to Bitcoin’s “gold,” a complementary alternative that supports everyday payments.

Key Differences Between Litecoin and Bitcoin

Transaction Speed

Bitcoin and Litecoin have distinct transaction speeds due to differences in block generation times. Bitcoin adds a new block to its blockchain approximately every 10 minutes, allowing it to process around seven transactions per second. This relatively slow transaction speed has made Bitcoin more suitable for large transactions or as a long-term investment.

In contrast, Litecoin’s blockchain adds a new block roughly every 2.5 minutes, allowing it to handle around 56 transactions per second—eight times faster than Bitcoin! This speed makes Litecoin a practical choice for smaller, frequent transactions, where faster confirmations are beneficial.

Hashing Algorithms

Bitcoin and Litecoin also differ in their hashing algorithms, which affects how they’re mined and secured. Bitcoin uses the SHA-256 (Secure Hash Algorithm 256-bit) algorithm, which requires significant computational power and is typically mined using specialized hardware known as ASICs (Application-Specific Integrated Circuits). As Bitcoin mining has grown more competitive, specialized equipment has become necessary, leading to some centralization in mining power among those who can afford ASICs.

Litecoin, on the other hand, uses the Scrypt algorithm. Scrypt is more memory-intensive than SHA-256 and was designed to allow for mining with standard CPUs and GPUs, making it more accessible for individual miners. While ASICs have since been developed for Scrypt, Litecoin’s algorithm still provides a slightly lower entry barrier for miners, aligning with its goal of being more accessible.

Maximum Supply and Halvings

Both Bitcoin and Litecoin have fixed supplies, making them “deflationary” assets, as they become scarcer over time. Bitcoin has a maximum supply of 21 million coins, while Litecoin has a cap of 84 million coins—four times that of Bitcoin. Both networks reduce their block rewards roughly every four years through “halving” events, designed to slow down the rate of new coin production.

Bitcoin’s halving occurs every 210,000 blocks, while Litecoin’s halving occurs every 840,000 blocks (four times Bitcoin’s schedule). This difference in supply and halving intervals means that Litecoin remains more abundant and accessible, while Bitcoin’s scarcity often contributes to its higher perceived value.

Similarities Between Litecoin and Bitcoin

Consensus Mechanism

Both Bitcoin and Litecoin rely on the Proof-of-Work (PoW) consensus mechanism to secure their networks. In PoW, miners compete to solve complex mathematical problems, validating transactions and adding blocks to the blockchain. This process ensures that the network remains decentralized, secure, and resilient to attacks.

Decentralization

A key principle of both Bitcoin and Litecoin is decentralization. Neither cryptocurrency is controlled by a single entity; instead, their networks are maintained by thousands of miners and nodes globally. This lack of central control makes both Bitcoin and Litecoin secure and resistant to censorship.

Open-Source Code

Both Bitcoin and Litecoin are open-source projects, meaning their code is publicly available and can be reviewed, modified, or built upon by anyone. This transparency promotes community participation and trust, as anyone can suggest improvements or identify vulnerabilities in the code.

Security

Security is a top priority for both Bitcoin and Litecoin. Each network uses cryptographic methods to secure transactions, making it highly difficult for malicious actors to alter the blockchain. Both currencies have proven resilient against attacks, thanks in part to their decentralized nature and active communities.

Use Cases: Bitcoin vs Litecoin

Bitcoin as a Store of Value

Bitcoin’s limited supply, high value, and broad acceptance have led to its reputation as “digital gold.” Bitcoin is increasingly viewed as a store of value rather than a transactional currency, making it appealing to investors and institutions as a hedge against inflation and market volatility.

Litecoin as a Medium of Exchange

Litecoin was created with transactions in mind, prioritizing speed and affordability. This makes it well-suited for day-to-day purchases and smaller payments. With lower transaction fees and faster confirmation times, Litecoin is a practical choice for those who prefer to use cryptocurrency for daily transactions.

Fun fact: Litecoin’s codebase is similar to Bitcoin’s, which has led it to act as a “testbed” for new features. For example, Litecoin was one of the first networks to adopt the SegWit (Segregated Witness) upgrade, which was later implemented on Bitcoin. This role has reinforced Litecoin’s reputation as a complementary, rather than competing, currency to Bitcoin.

Market Capitalization

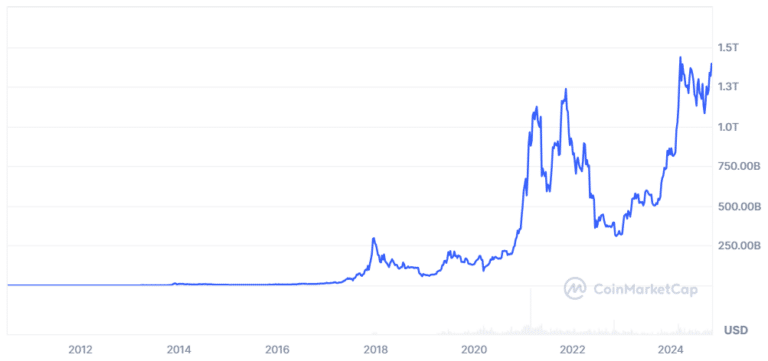

Bitcoin’s Market Cap

Bitcoin’s value and demand often give it the largest market cap among cryptocurrencies, given its current market cap of over $1 trillion. This demand is partly driven by Bitcoin’s limited supply and its reputation as a secure, stable asset. Market sentiment heavily influences Bitcoin’s price, as investors often view it as a hedge against traditional financial market risks.

Litecoin’s Market Cap

Litecoin’s market cap, while significantly smaller, remains within the top 20 cryptocurrencies. With a total value of over $5 billion, Litecoin is more affordable for the average user, making it attractive as a more accessible alternative. On a high-volume day, Bitcoin transactions can total $39 billion in 24 hours, while Litecoin’s volume typically sits closer to $350 million, reflecting the distinct roles each currency plays.

Bitcoin vs Litecoin Mining

Bitcoin Mining

Bitcoin mining has grown competitive and energy-intensive, mainly due to the SHA-256 algorithm and the requirement for specialized ASICs. This exclusivity has contributed to some centralization of mining power among those with the resources to invest in ASIC equipment. Mining Bitcoin requires substantial power, leading to criticism about its environmental impact.

Litecoin Mining

Litecoin mining, in contrast, was initially more accessible due to the Scrypt algorithm, allowing users to mine with standard CPUs and GPUs. While Scrypt ASICs have since become available, Litecoin’s mining remains less centralized compared to Bitcoin. The memory-intensive nature of Scrypt also contributes to lower overall energy consumption, making Litecoin mining slightly less taxing on the environment.

Pros and Cons of Bitcoin and Litecoin

Bitcoin

- Pros: Higher value, widely accepted as a store of value, large institutional adoption.

- Cons: Slower transaction speed, higher transaction fees, mining centralization.

Litecoin

- Pros: Faster transaction speed, lower transaction fees, accessible mining, suitable for daily transactions.

- Cons: Lower market cap than Bitcoin, smaller institutional acceptance, less widely accepted.

Which is Better: Bitcoin or Litecoin?

Deciding between Bitcoin and Litecoin ultimately depends on your individual needs and goals within cryptocurrency. Bitcoin is often preferred by those looking for a long-term store of value, while Litecoin’s faster transaction times and lower fees make it appealing for everyday use. Each cryptocurrency has its unique strengths, and choosing the right one comes down to how you plan to use or hold your digital assets.

Where to Buy Bitcoin and Litecoin

If you’re ready to purchase Bitcoin or Litecoin, RockItCoin provides convenient options to get started. Here’s how to buy either cryptocureency using a RockItCoin ATM and the RockItCoin app.

How to Buy Bitcoin and Litecoin with a RockItCoin ATM

- Locate a RockItCoin ATM: Use RockItCoin’s Bitcoin ATM map or the RockItCoin app to find the nearest ATM. With thousands of locations across the country, RockItCoin makes buying Bitcoin and Litecoin convenient.

- Prepare Your Wallet: Before heading to the ATM, ensure you have a digital wallet on your smartphone to receive and store your cryptocurrency. If you don’t have one, you can set up a wallet directly on the RockItCoin app.

- Select Litecoin on the ATM: Once at the RockItCoin ATM, follow the on-screen instructions to select Bitcoin (BTC) or Litecoin (LTC) as your purchase option.

- Scan Your Wallet QR Code: The ATM will prompt you to scan the QR code of your wallet. This ensures that the cryptocurrency you purchase will be sent directly to your wallet.

- Insert Cash and Confirm: Insert the amount of cash you want to convert, confirm your transaction, and complete the purchase. Your crypto will be sent to your wallet within minutes!

Using a RockItCoin ATM is a straightforward and fast way to buy Bitcoin and Litecoin, especially for those who prefer dealing in cash and want immediate access to their cryptocurrency.

How to Buy Bitcoin and Litecoin on the RockItCoin App

- Download the RockItCoin App: If you haven’t already, download the RockItCoin app from the App Store or Google Play. The app provides a secure, user-friendly experience for buying and managing cryptocurrencies.

- Create or Connect Your Wallet: Set up a digital wallet in the RockItCoin app by following the easy steps provided.

- Select Your Purchase Option: From the ‘buy with a credit or debit card’ menu, select Bitcoin (BTC) or Litecoin (LTC) as your desired cryptocurrency.

- Choose Payment Method: The RockItCoin app allows you to buy Litecoin using a variety of payment methods, including credit cards, debit cards, Apple Pay, and Google Pay.

- Enter the Amount and Complete Purchase: Decide how much Litecoin you want to purchase, enter the amount, and confirm the transaction. Your Litecoin will be delivered directly to your wallet in the app within minutes.

The RockItCoin app is a convenient choice for users who want the flexibility to buy Litecoin anytime, anywhere, with the added security of an in-app wallet.

Whether you prefer using cash at a RockItCoin ATM or making a quick purchase through the RockItCoin app, buying Bitcoin and Litecoin has never been easier.

Conclusion

In the debate of “Litecoin vs Bitcoin,” both cryptocurrencies bring unique strengths to the table. Bitcoin, the “digital gold,” serves as a stable, long-term store of value, while Litecoin, the “digital silver,” shines as a quick, low-cost transactional currency. Understanding these differences can help you choose the cryptocurrency that best fits your needs.

Ready to get started? Visit a RockItCoin ATM or download the RockItCoin app today to start your journey with Litecoin or Bitcoin. Each currency offers distinct benefits, and RockItCoin makes it easy to find the right solution for your crypto goals.

Frequently Asked Questions (FAQ)

What is the main difference between Bitcoin and Litecoin?

The main difference between Bitcoin and Litecoin lies in their transaction speed and purpose. Bitcoin, often referred to as “digital gold,” has a block time of 10 minutes, making it slower but suited for large transactions and long-term investments. Litecoin, known as “digital silver,” has a block time of 2.5 minutes, enabling faster transactions and making it more practical for everyday purchases.

Is Litecoin better for everyday transactions than Bitcoin?

Yes, Litecoin is generally better for everyday transactions due to its faster block generation time of 2.5 minutes, allowing for quicker transaction confirmations. Additionally, Litecoin often has lower transaction fees compared to Bitcoin, making it ideal for small, frequent transactions.

Can I buy Litecoin with cash?

Yes, you can buy Litecoin with cash at a RockItCoin ATM. Simply locate a nearby RockItCoin ATM, select Litecoin as your purchase option, and follow the on-screen instructions. RockItCoin ATMs are available in many locations, making it easy to buy Litecoin securely with cash.

What is the maximum supply of Bitcoin and Litecoin?

Bitcoin has a maximum supply of 21 million coins, while Litecoin’s maximum supply is 84 million coins—four times that of Bitcoin. Both cryptocurrencies undergo periodic “halving” events that reduce the rate of new coin creation, contributing to their value and scarcity over time.

Can I buy Bitcoin or Litecoin using the RockItCoin app?

Yes, you can buy both Bitcoin and Litecoin using the RockItCoin app. The app provides a secure and easy way to purchase cryptocurrencies with a debit or credit card. It also includes a built-in wallet, allowing you to manage your Bitcoin and Litecoin in one place.

Why is Bitcoin called “digital gold” and Litecoin “digital silver”?

Bitcoin is often called “digital gold” due to its higher value, limited supply, and reputation as a store of value. Litecoin, with faster transaction times and lower fees, is referred to as “digital silver” and is more practical for everyday transactions. This analogy helps users understand the complementary roles of each cryptocurrency.